In pursuit of stability and predictability, but not the status quo

If you do not like the answers to your questions, maybe it is time to change your premise

PROVIDENCE – Everybody is crying health care, when they do not know the meaning of the word, to paraphrase a lyric from blues singer Mose Allison.

A bad enough situation is sure enough getting worse, the song by Allison continues. Everybody is crying justice, just as long as it’s business first.

For all the billions upon billions of words spoken [and dollars spent] on health care, particularly as Republicans in the Senate pursue yet another partisan attempt to repeal Obamacare and replace it with Trumpcare, the bottom line is this: the commercial health insurance market in America remains a murky enterprise for the consumer, one where the risks, costs and accountability are not spread evenly.

To help level the playing field, the consulting group, Leverage GC, has developed an innovative insurance database at a detailed, granular level, examining the health plans offered by commercial carriers in each state, for each market segment.

Our analysis showed: Republican leaders' assumptions about the causes of high premium levels, lack of choice and low patient care in the individual and small group markets do not stand up to closer examination.

Further, Republican leaders do not understand the magnitude of the difference in cost between what they pay and what their constituents pay for the same overage.

Finally, small businesses and entrepreneurs will continue to be priced out of buying the same coverage that members of Congress as well as corporate, federal and state employees take for granted.

Market segments

The current commercial insurance market can be broken down into six segments: Individual/Family [non-group); Small Group; Large Group; Large Self-Insured; Federal Employees; and State and Municipal Employees.

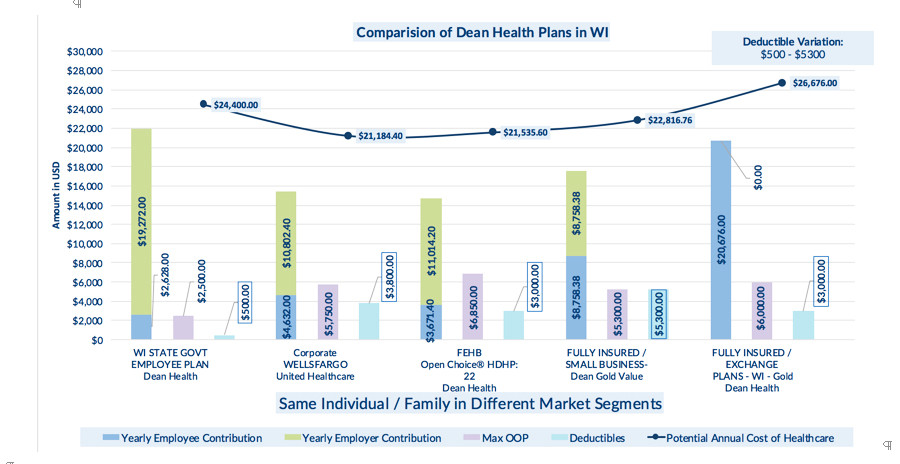

To illustrate our efforts, we chose to use Wisconsin, which currently has a competitive market, and House Speaker Paul Ryan [with a $223,000 salary, married with three children], as a prototypical example. We examined the costs of insurance plans in each market segment for three competitive health plans in Wisconsin: Dean Health, Health Partners, and Anthem.

What we uncovered was that there was a huge gap in the total premium cost in the Wisconsin insurance market for plans offered by the same carrier, with comparable benefits in different market segments. Further, the cost differential was worsened by a radically different "value proposition" for the individual.

• For instance, for virtually the exact same benefits coverage from Dean Health, Ryan as a federal employee, would pay only $3,761 a year, tax exempt, compared to paying $20,676, with after tax dollars, for a comparable family “gold” plan on the state’s health exchange.

• Similarly, once again, for virtually the exact same benefits coverage from Health Partners, Ryan and other federal employees would pay $7,728, compared to $26,580 for a fully insured family “gold” plan on the state’s health exchange.

• For state employees, for virtually the exact same benefits coverage from Anthem Blue Cross Blue Shield, the state employee contribution is $2,260, compared to $45,948 for the Gold/Direct Access plan for families and individuals on the state’s health exchange.

Challenging the premise

To a large degree, the key elements of the partisan Republican legislation to repeal Obamacare and replace it with Trumpcare continue to focus on the wrong issues -- if the stated goals of lowering cost and increasing coverage and quality are sincere.

The potential total pool of enrollees, the richness of the benefits, the elimination of pre-existing condition exclusions, and the cost of drugs and services are factors in the overall cost of health insurance, but they are not the defining cause issues for higher costs in the small business and individual markets.

Carrier participation and lower total premium pricing in these markets is significantly driven by stability and predictability. What we found in our research is that within the same insurance carrier, the total premium cost and risk for the same or similar package of benefits, provider network and comparable out-of-pocket costs is less in three market segments: large self-insured, federal employees, and state and municipal employees.

What are the reasons why carriers eagerly participate in these three markets, providing lower costs and lower premiums? The factors include: a high value proposition for broad enrollment by employees, high subsidies, wide choice, and robust competition.

More specifically, our research and analysis found:

• All enrollees pay less than 25 percent of the premium. To the enrollee, the value question is the cost of their package. The answer is radically different if it is $3,671, compared to nearly $21,000. Lower costs to the enrollee ensure higher rates of participation; the remainder is paid by the employer.

• All enrollees pay the same amount, regardless of age, health status, geography or gender.

• The aggregated payment is sent to the carrier regularly, with automatic payments from the employer and the enrollee.

• There is an entity negotiating on behalf of the enrollee and facilitating between the carrier and the enrollee.

As a result, these market segments provide carriers with a predictably high percentage of enrollment, reliable payment, and transparent market rules of engagement, allowing them to focus on innovative management of medical expenses rather than on cherry picking the risk pool.

Remedying the situation

Health care is one-sixth of the American economy and the costs of health care are expected to be 50 percent of the average American household income by 2025. The overarching problem is not only the ever-increasing cost of medical products and services but the segmentation of markets and the lack of transparency.

Passing and implementing the proposed Graham-Cassidy Senate legislation as currently constructed will both exacerbate these problems and make the heath care ecosystem far worse. Overall costs will soar, state budgets will collapse, and only the very rich will be able to work outside of government or a large corporation.

Until now, there has been no comprehensive ability to compare and analyze commercial health plans at a detailed level across market segments to provide perspective and identify the real premium cost drivers.

At the same time, the underlying political divide around Obamacare vs. Trumpcare is what role should the federal and state governments be playing in regulating health care.

[What has been fascinating to watch, in the aftermath of recent hurricanes, is the way that those who oppose federal involvement and spending as a political philosophy have no problem advocating on behalf of investing federal resources for disaster relief for their own districts.]

If the Congress can get beyond the repeal and replace rhetoric, here are some principles that under girded the initial Republican health care reform efforts in the 1990s and 2000s to reconsider:

• Competition: Create a fair playing field, with broad benefit categories and network adequacy to allow innovation in bringing down costs

• Freedom to work: Ensure that small businesses and entrepreneurs pay the same amount in premium contributions and receive the same tax benefits that government and corporate employees pay for comparable benefits.

• Flexibility and Predictability: Create a stable and predictable environment using state entities to negotiate, rather than regulate, with carriers on behalf of individuals and flexibility for the states to merge market segments and incorporate Medicaid

• Choice and Transparency: Let the private sector do what they do best – develop innovative plan designs and value-based provider contracting, and let the government create transparency based on value, limit cherry picking, and provide consumer support to make the best choice.

• Individual Responsibility: Give individuals and patients access to the information they need to be true partners in getting care and evaluating cost. Mandates will not work if the value proposition does not exist.

Crafting a better solution

Obamacare has its flaws, flaws that need to be fixed. We have confidence that a better solution can be crafted if Congress takes the time to re-evaluate core assumptions, incorporate new information, and consider practical experience in a bipartisan manner.

The reason most Republicans in Congress [and the President] don’t spend the time to understand the fundamentals of health care coverage, cost and outcomes may be because most have never actually experienced paying full premium prices; they are completely insulated from the cost of health care.

In addition, they could not easily compare their own coverage’s cost and benefit structure to that of their constituents; neither could their close advisors, lobbyists, policy analysts or pundits. But now we can.

This won’t change the minds of Republicans who simply want to eliminate federal funding for all health care programs, but for the rest, we are happy to provide the detailed information we use and share how it can be applied to support crafting reform that has a chance of addressing the issues causing the anger about health care by improving coverage, protecting personalized care, driving competition and lowering the overall costs.