Smart science, shrewd business acumen, drives Mnemosyne toward success

Providence-based drug R&D firm’s research platform explores promising new opportunities for small molecule drugs to treat neuropsychiatric disorders

What will it take? Michael Shuman’s treatise, “Local Dollars, Local Sense: How to shift your money from Wall Street to Main Street and achieve real prosperity,” offers one starting point. AS220’s discussion about “Building Community” offers a different starting point, focused on community development. Is there a third way to look creating a new kind of community bank that invests in Rhode Island’s future economic development?

PROVIDENCE – When Mnemosyne, an early stage pharmaceutical R&D firm headquartered at 1 Davol Square, first launched in 2010, it focused on research to develop a new small molecule drug therapy to treat schizophrenia.

The company is named for Mnemosyne, the Greek goddess of memory. It targeted a “subunit selective” NMDA receptor modulator in the brain – what the firm termed “the brain’s master switch for learning and memory” – and its role in regulating synaptic plasticity, the molecular mechanism associated with learning and memory.

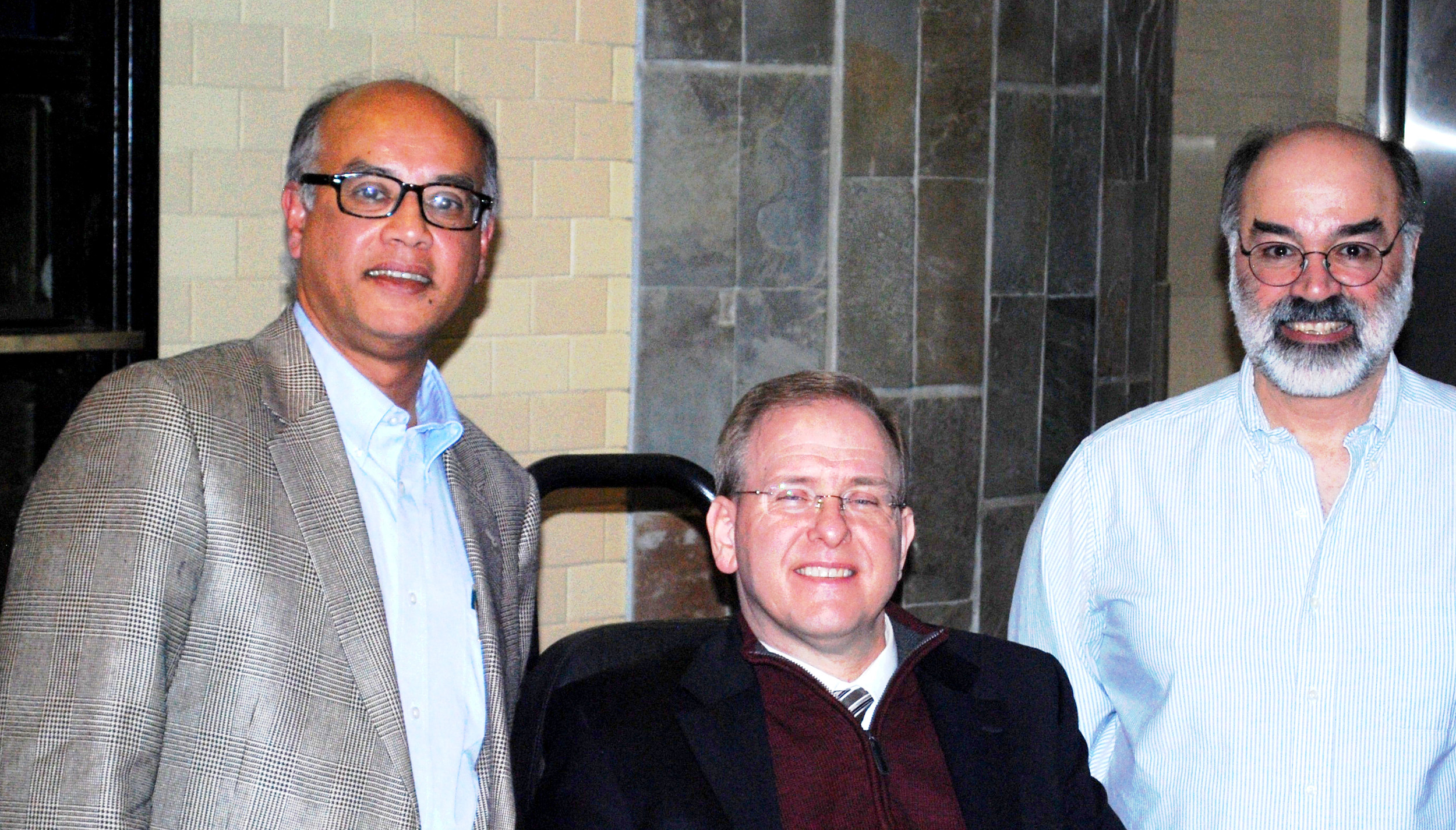

Two of the co-founders, Kollol Pal, the CEO, who is an experienced entrepreneur from the Boston biotech world, and Frank Menniti, the chief scientific officer, who is an expert in small molecule therapeutics and who worked for almost two decades with Pfizer, first met serendipitously.

Richard Horan, senior managing director at Slater Technology Fund, asked them to serve as technical scientific advisors to review a potential investment – an opportunity that they recommended to Slater to decline.

But the chance meeting of Pal and Menniti grew into a continued conversation, and they found themselves meeting regularly in Providence – a convenient middle ground for the Boston-based Pal and the Groton-based Menniti – to sketch out the details of their new venture.

Initial funding came from the Slater Technology Fund in May of 2010, with the first of two $250,000 investments. Since then, Mnemosyne has raised $11.5 million in Series A financing, including most recently $6 million in July of 2013, with new investment support coming from Atlas Venture and continued support from Clal Biotechnology Industries.

Their research platform – initially focused on schizophrenia – has now branched out to include drug development opportunities for depression and Rett Syndrome [a genetic neurodevelopmental disorder that occurs almost exclusively in girls]. There is the potential to enter into clinical partnerships as early as 2015, according to Pal.

In addition, the company’s research has also uncovered potential to develop new compounds to address traumatic brain injury and post-traumatic stress disorders.

ConvergenceRI sat down recently with Pal to discuss the challenges that Mnemosyne faces as it moves forward to pursue promising new opportunities created on the strength of its recent platform – and the company’s leadership role in Rhode Island as a drug research development firm.

ConvergenceRI: How does the potential of new drug development opportunities speak to the nimbleness of Mnemosyne as a firm – to be able to respond to research findings?

PAL: When we started, we started with the idea of this [brain] receptor that controls learning and memory. We thought of it as a platform for a number of different therapeutic indicators.

When we got started, our initial indication was going to be a drug for schizophrenia, which addressed mainly the negative symptoms of the cognitive disorder.

There are anti-psychotic drugs which address the positive symptoms [delusions, disordered thoughts and hallucinations regarded as manifestations of psychosis] of schizophrenia. Our goal was to address the cognitive and negative symptoms [deficits of normal emotional responses and thought processes].

When we started, [we believed our research platform] would identify other compounds for other indications. And that has turned out to be exactly the case.

We now have three research programs – one in depression, one in Rett Syndrome, and one in schizophrenia.

What’s interesting is that the other two programs – as research would have it – have gone ahead of the initial schizophrenia program in development.

We’re probably going to be at a stage to select a clinical candidate for the depression program sometime in 2015, as well as clinical candidates for the Rett Syndrome program sometime in late 2015.

The fact that both of these research programs began in early- to mid- 2013 shows that we’re hoping to have a clinical candidate in about two years – demonstrating that our research platform can generate a number of therapeutic opportunities.

ConvergenceRI: What does it require – is it an ability to be flexible, or nimble – for a company to start in one direction in research, and then have to pivot?

PAL: I think it’s nimbleness – and being receptive to [responding to] the perspectives in the literature around you. Being able to implement what is being identified in the [research] world around you.

For instance, with the Rett Syndrome program, a paper was published by a researcher at Boston Children’s Hospital – she published a paper that linked the NMDA receptors to a therapeutic strategy for Rett Syndrome.

We immediately were able to implement her findings into our research program and start a drug discovery effort for Rett Syndrome. With that, we were able to get some of the foundations that support Rett Syndrome to give us a pretty sizeable research grant to support the work in the Boston Children’s Hospital lab with one of our lead compounds.

It’s not just what goes on inside Mnemosyne, but what’s happening outside Mnemosyne – to keep an open mind and be receptive to the research findings around you.

And, it was the same thing with the depression program. There were a series of clinical observations that a nonselective NMDA antagonist [Ketamine], was having profound effects on improving depression very rapidly.

One of the problems with the drugs that are available to treat depression, like Prozac, is that it takes time to work; it generally takes four to six weeks, and in that time period, a patient’s depression is not being treated.

We were able to link the Ketamine clinical studies to one of our research platforms, and we started a research unit around that. And that program has really accelerated.

Being receptive – that nimbleness – does present its own challenges. The funding challenge is to do three groups instead of one. It is much, much harder. Research is ultimately linked to funding resources.

Right now, we are aggressively pursuing funding for all three of our research programs.

We are also very aggressively pursuing partnering discussions.

At the end of the day, the initial funding that we got isn’t sufficient to support three programs. We need additional funding.

ConvergenceRI: Isn’t that a good problem to have? Having more than one choice?

PAL: Having more than one choice is a challenge in itself. The discussion we are having within Mnemosyne, with our board, is: what is our research strategy, and what is our financing strategy? Which programs do we work on? Which programs do we carry forward internally? And which do we partner on?

If we partner, whom do we partner with? If we’re going to raise money, how much money are we going to raise? Which programs do we take all the way through clinical trials ourselves?

These are all challenges that are part of growing an early stage company like Mnemosyne. These are good problems to have. But there are significant financial challenges that go with it.

ConvergenceRI: How do you make those kinds of decisions? Is it by intuition? Is it based on your past business experience?

PAL: I would say that this is where the experience of the team has really allowed for our success. My co-founder and I, we both have spent 25 plus years in the pharmaceutical industry, both in Big Pharma and in biotech, and in the venture [capital] industry. We have a very good understanding of the research process.

In addition, I would say Mnemosyne benefits from a very strong, supportive board of directors, comprised of financial people with strong scientific expertise. We have a very strong scientific advisory board, which brings together some of the best academic and clinical researchers to advise us on our research programs.

I would say that it is intuitive – it’s easy to follow good science, but it’s also enabled by having good advisors who are supportive of our mission.

ConvergenceRI: Is that an important lesson for other companies and entrepreneurs from startups, to take the time to put together a good leadership team?

PAL: Investors invest in people, not necessarily in the technology. The technology can work, or not work. But it’s the people that make a company. I would say that Mnemosyne has a very strong management team, very strong advisors and board.

ConvergenceRI: What are the advantages that Rhode Island offers Mnemosyne as early stage drug R&D company?

PAL: For our business model, Rhode Island has been a very good place to start and run our company. Obviously, one of the reasons we are in Rhode Island is because, initially, we got funding for the Slater Technology Fund, which enabled us to get started.

This initial investment getting us started in 2010 was very important, because raising money for an early stage drug discovery company is very challenging.

I live up in Boston, I bring my biotech experience to the table. Frank Menniti, my co-founder, spent nearly 20 years at Pfizer – and he really knows the research strategy and programs of Big Pharma.

Ultimately, we will need to partner with Big Pharma companies to be successful.

I think what Providence provided us was an intermediate meeting place for both people from the Boston-Cambridge area and from Mystic-Groton area. Certainly, there are advantages to being right here in the Jewelry District. Brown is rapidly emerging as a very strong neurosciences school, and the long-term opportunity for Mnemosyne to establish itself in Providence is quite appealing.

That being said, I think Mnemosyne’s unique business model – recruiting experienced leaders from both Big Pharma and biotech, has allowed us to be able to locate in Providence.

Most of our research is done overseas. That enables us to have our corporate offices in Providence while we’re running research operations in India and Italy, taking advantage of the best research service providers, and not being restricted. Our business model really enables that.

ConvergenceRI: Are there specific Rhode Island opportunities to explore?

PAL: That’s really a good question. Yes, our research platform keeps growing branches. As we discussed earlier, the good side about having a solid research platform is that you can expand. The bad side about having a research platform that can expand is that it needs significant financial backing to enable all of its programs.

One of the areas of research we’ve been very, very interested in is the opportunity for our platform to provide treatments for traumatic brain injury and post-traumatic stress disorder.

We’ve met with Sen. Jack Reed and with Rep. Jim Langevin to see if they can facilitate connections with the Department of Defense and the Veterans Administration to see if we can get additional funding to support these research programs.

One of the challenges of being a venture-backed company is what areas of research are venture-backable and what areas of research are not venture-backable.

Things like PTSD and TBI are, in the short run, harder to support with investor money.

One of the things that I am especially interested in Rhode Island, with the new neuroscience center opening up at URI, and the focus on the brain at Brown, is whether there is an opportunity to bring some of that research into broad collaborations with companies such as Mnemosyne, to work on novel treatments for traumatic brain injury and post-traumatic stress disorder. That’s an important drug discovery opportunity or therapeutic development opportunity that could result from our platform, but is not necessarily going to be supported by investments in the short term.

ConvergenceRI: In the short-term, immediate future, what kind of resources are you looking for to get the work on TBI and PTSD up and running?

PAL: In the immediate future, $1 million to $2 million, to flesh out the basic science to see whether our compounds would work in TBI and PTSD. Then, once we have demonstrated that the compounds would be therapeutically beneficial, I think it is going to require significantly more funding to actually enable the drug development process.

Hopefully, once we’ve demonstrated that we have a novel way of treating these diseases – that we can actually improve memory and improve learning and suppress bad memories – then we hope that there would be additional funding available to put these molecules into development.